In China’s competitive market, success starts with understanding your target audience. At Chaoly, we guide brands through China consumer research, using tools like social listening, customer interviews, and surveys to gain deep insights into Chinese consumer behavior. Whether your innovation and R&D departments are developing new products or looking to improve existing ones, we help you identify key consumer pain points and understand their needs. With over 70% of new products in China failing to meet expectations, our approach ensures your product is created based on real China consumer market research and China market insights, giving you a competitive edge when marketing to Chinese consumers.

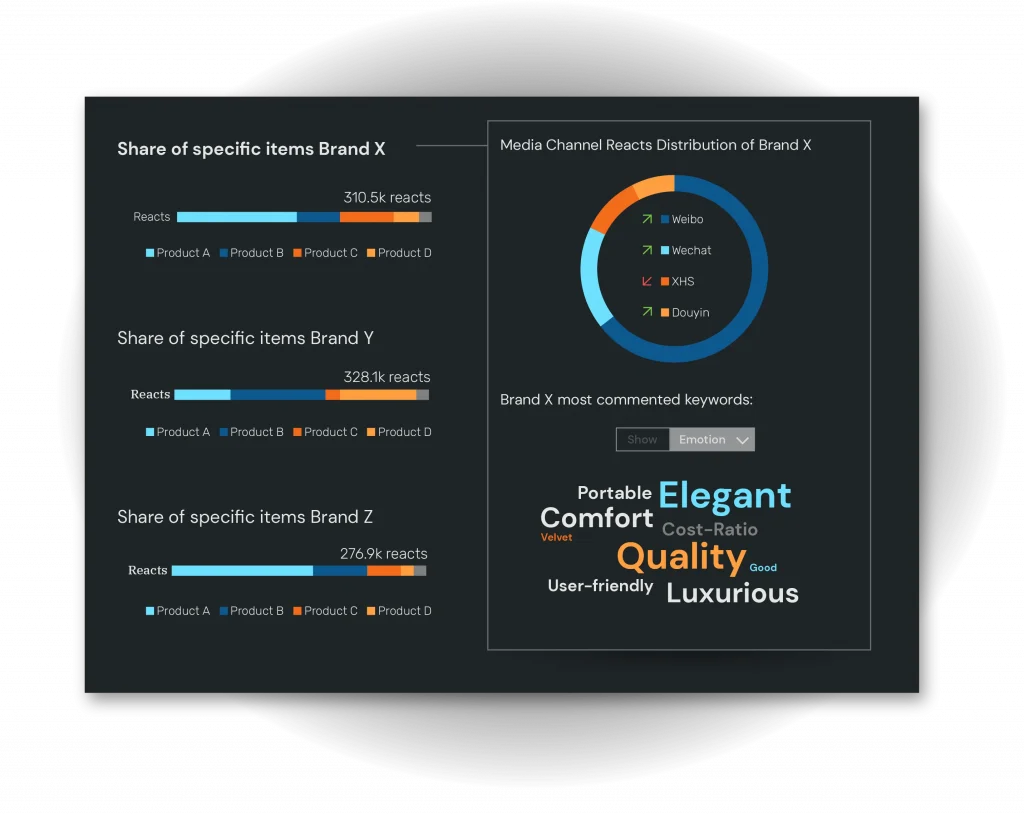

The customer discovery process begins with social listening on platforms like WeChat, Douyin, XiaoHongShu, and Weibo. We track real-time conversations to identify emerging trends, consumer sentiment, and preferences, helping you understand how to market to Chinese consumers effectively. In addition to this, we conduct customer interviews and online surveys to dig deeper into consumer pain points, behaviors, and product expectations. We also collaborate with niche influencers who share these surveys within their private networks, reaching early adopters who provide crucial feedback on potential solutions. This combination of online tools, surveys, and influencer engagement ensures comprehensive data collection, helping you understand what drives Chinese consumers and provides valuable China consumer research and China market insights.

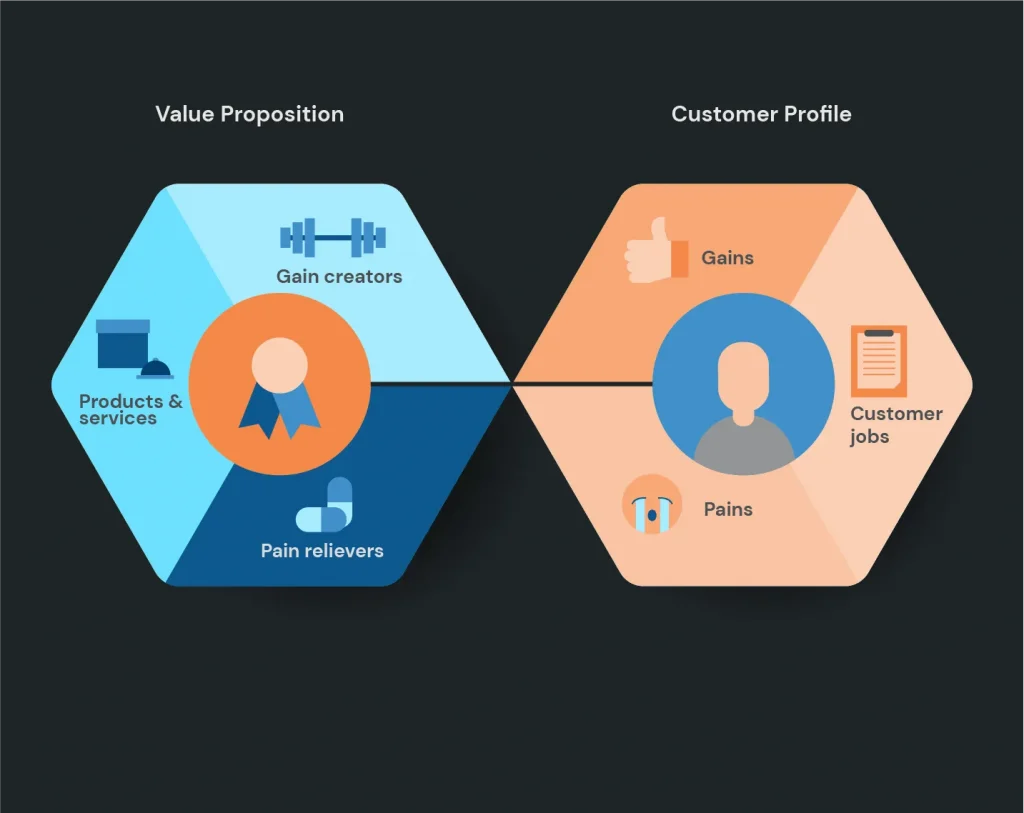

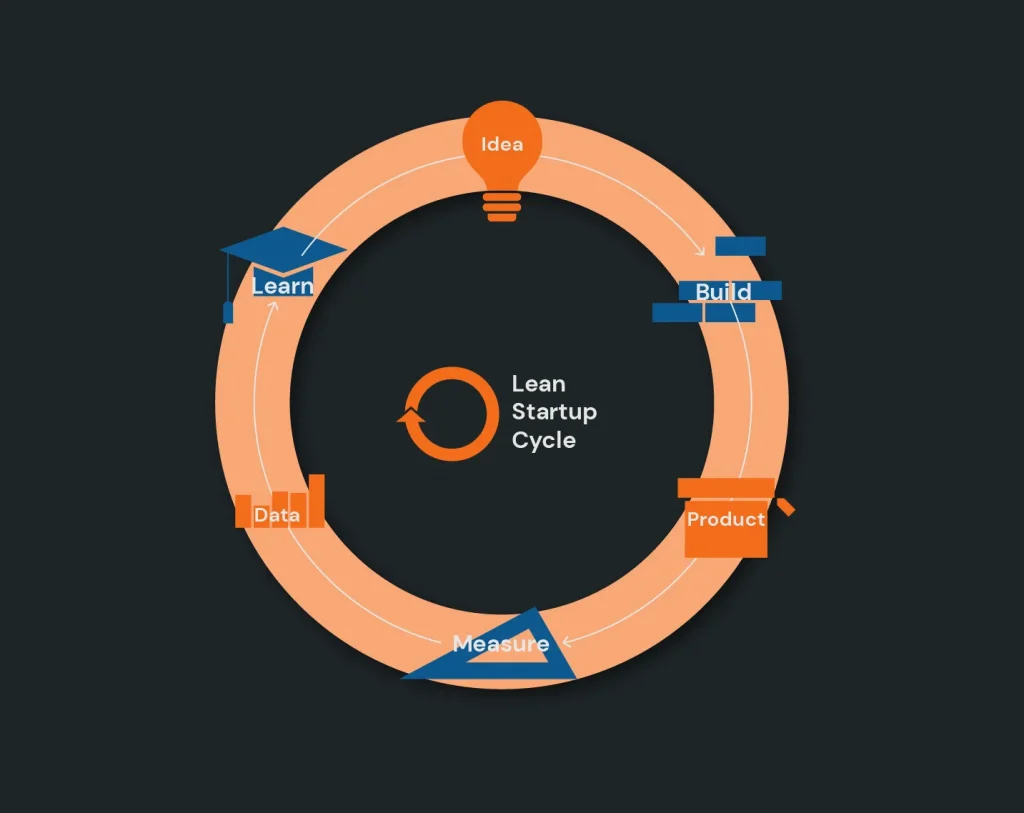

After collecting and analyzing insights, we use the Value Proposition Canvas to refine your product’s value proposition and target audience’s customer profile. By testing assumptions about Chinese consumer behavior, we identify which features, pricing, and packaging will resonate most with your audience. We use mock-ups and small-scale experiments to validate product concepts, ensuring your product-market fit is strong before scaling up. This process mitigates risk by focusing on validated solutions rather than assumptions. The result is a product tailored specifically to the needs of Chinese consumers, helping you understand how to market your business in China effectively using China consumer market research.

The insights gained from customer discovery directly inform the next phase: Marketing to Chinese consumers through Marketing-Mix Optimization. We test product concepts, pricing, and packaging with real shoppers in the Alibaba ecosystem. This helps validate and refine your marketing mix to ensure it resonates with Chinese consumers. The R&D teams of Nestlé and Philips have used this approach, optimizing new ingredients and product features during the development process. This alignment ensures that these elements are tailored to the needs and preferences of the Chinese target customer, maximizing your product’s success.